Salary Vs. Hourly: Unveiling The Distinctions

When it comes to employment, one of the most important decisions you will make is whether to accept a job that pays a salary or one that pays by the hour. While both offer benefits and drawbacks, understanding the differences between the two can help you make an informed decision about which option is best for you.

What is a Salary?

A salary is a fixed amount of compensation paid to an employee on a regular basis, regardless of the number of hours worked. Typically, salaried employees are exempt from overtime pay and may be expected to work more than 40 hours per week without additional compensation.

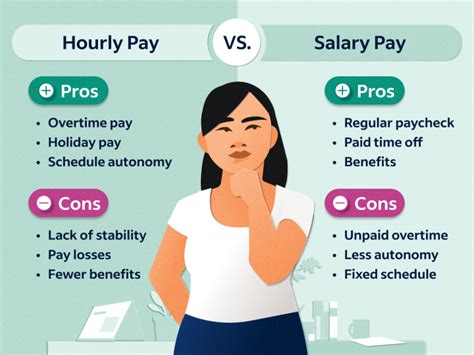

Pros of a Salary

- Stable income: Salaried employees can count on a consistent paycheck, even during slow periods or when they take time off.

- Better benefits: Employers often offer better benefits packages to salaried employees, including health insurance, retirement plans, and paid time off.

- Career growth: Salaried positions often offer greater opportunities for career advancement and increased responsibility.

Cons of a Salary

- Longer hours: Salaried employees may be expected to work longer hours, including evenings and weekends, without additional compensation.

- No overtime pay: Salaried employees are typically exempt from overtime pay, even if they work more than 40 hours per week.

- Less flexibility: Salaried employees may have less flexibility in their work schedules and may be required to be available outside of normal business hours.

What is Hourly Pay?

Hourly pay is compensation that is based on the number of hours worked. Typically, hourly employees are eligible for overtime pay if they work more than 40 hours per week and their hourly rate is multiplied by 1.5 for each hour worked over 40.

Pros of Hourly Pay

- Overtime pay: Hourly employees are eligible for overtime pay if they work more than 40 hours per week, which can significantly increase their income.

- Flexibility: Hourly employees may have more flexibility in their work schedules and may be able to work part-time or on a flexible schedule.

- No unpaid work: Hourly employees are only paid for the hours they work, so they are not expected to work for free.

Cons of Hourly Pay

- Unstable income: Hourly employees may experience fluctuations in their income based on the number of hours worked and the availability of work.

- Less benefits: Hourly employees may receive fewer benefits than salaried employees, such as health insurance and retirement plans.

- Less career growth: Hourly positions may offer fewer opportunities for career advancement and increased responsibility.

Which is Right for You?

Choosing between a salary and hourly pay can depend on your personal and professional goals. If you value stability and career growth, a salaried position may be the best choice for you. If flexibility and the potential for higher earnings are more important, an hourly position may be a better fit. Ultimately, the decision should be based on your individual needs and priorities.

Frequently Asked Questions

What is the difference between a salary and hourly pay?

A salary is a fixed amount of compensation paid to an employee on a regular basis, regardless of the number of hours worked. Hourly pay is compensation that is based on the number of hours worked.

Are salaried employees eligible for overtime pay?

Salaried employees are typically exempt from overtime pay, even if they work more than 40 hours per week.

Can hourly employees receive benefits?

Hourly employees may be eligible for benefits such as health insurance and retirement plans, but these benefits may be less comprehensive than those offered to salaried employees.

What factors should I consider when choosing between a salary and hourly pay?

You should consider your personal and professional goals, the stability of the position, the potential for career growth, and the potential for overtime pay or increased earnings.

Can I negotiate my pay structure with my employer?

It may be possible to negotiate your pay structure with your employer, but this will depend on the company’s policies and your individual circumstances.