Calculating Annual Growth Rate: Step-By-Step Guide

Are you looking to calculate the annual growth rate of a company or investment? Understanding how to calculate the annual growth rate is essential for analyzing financial data and making informed decisions. In this step-by-step guide, we will walk you through the process of calculating the annual growth rate, from gathering the necessary data to interpreting the results. By the end of this guide, you will have a clear understanding of how to calculate the annual growth rate and apply it to your financial analysis.

Table of Contents

- Step 1: Gather the Initial and Final Values

- Step 2: Calculate the Growth Value

- Step 3: Divide the Growth Value by the Initial Value

- Step 4: Multiply by 100 to Get the Annual Growth Rate

- Step 5: Interpret the Annual Growth Rate

- Example Calculation

- FAQs

Step 1: Gather the Initial and Final Values

The first step in calculating the annual growth rate is to gather the initial and final values. These values represent the starting and ending point of the growth period you want to analyze. For example, if you are calculating the annual growth rate of a company’s revenue over a 5-year period, you would need the revenue values for the first and fifth year.

Step 2: Calculate the Growth Value

Once you have the initial and final values, you can calculate the growth value. The growth value is the difference between the final value and the initial value. This value represents the total growth over the period you are analyzing.

Step 3: Divide the Growth Value by the Initial Value

To calculate the annual growth rate, divide the growth value by the initial value. This will give you a decimal value that represents the growth rate as a proportion of the initial value.

Step 4: Multiply by 100 to Get the Annual Growth Rate

To convert the growth rate to a percentage, multiply the decimal value by 100. This will give you the annual growth rate as a percentage.

Step 5: Interpret the Annual Growth Rate

Once you have calculated the annual growth rate, it is important to interpret the result in the context of your analysis. A positive growth rate indicates an increase in value over time, while a negative growth rate indicates a decrease in value. The magnitude of the growth rate can also provide insights into the rate of growth or decline.

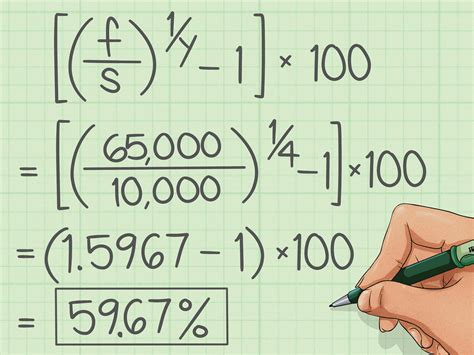

Example Calculation

Let’s take an example to illustrate the calculation of the annual growth rate. Suppose you want to calculate the annual growth rate of a company’s revenue over a 3-year period. The revenue values for the first and third year are $1,000 and $1,500, respectively.

Step 1: Gather the Initial and Final Values

Initial Value: $1,000

Final Value: $1,500

Step 2: Calculate the Growth Value

Growth Value: $1,500 – $1,000 = $500

Step 3: Divide the Growth Value by the Initial Value

Growth Rate: $500 / $1,000 = 0.5

Step 4: Multiply by 100 to Get the Annual Growth Rate

Annual Growth Rate: 0.5 * 100 = 50%

Step 5: Interpret the Annual Growth Rate

The annual growth rate of the company’s revenue over the 3-year period is 50%. This indicates a significant increase in revenue over time.

FAQs

Q: Why is it important to calculate the annual growth rate?

Calculating the annual growth rate allows you to measure the rate of change in a company’s financial performance or the growth of an investment. It provides valuable insights into the trend and direction of growth, which can help in decision-making and forecasting.

Q: Can the annual growth rate be negative?

Yes, the annual growth rate can be negative if there is a decline in the value being analyzed. A negative growth rate indicates a decrease in value over time.

Q: Are there any limitations to using the annual growth rate?

While the annual growth rate is a useful metric, it should be used in conjunction with other financial indicators and analysis methods. It does not capture the full picture of a company’s financial performance and should be interpreted in the context of the industry and market conditions.

Q: How can I use the annual growth rate in financial analysis?

The annual growth rate can be used to compare the performance of different companies or investments, assess the effectiveness of business strategies, and forecast future financial performance. It provides a standardized measure to evaluate growth and make informed decisions.