Decoding Salaried Employees: Understanding The Status

Being a salaried employee is a common work arrangement in many industries. It is a type of employment where an employee receives a fixed salary regardless of the number of hours worked. However, being a salaried employee comes with its own set of rules and regulations. In this article, we’ll be discussing what it means to be a salaried employee, the benefits and drawbacks, and how to properly classify employees under this status.

What is a Salaried Employee?

A salaried employee is someone who is paid a fixed amount of money on a regular basis, typically once a month. This amount of money is predetermined and does not vary with the number of hours worked. Salaried employees are typically classified as exempt employees, which means they are not entitled to overtime pay.

The Benefits of Being a Salaried Employee

Stability and Predictability

One of the biggest benefits of being a salaried employee is the stability and predictability it provides. Since salaried employees receive a fixed amount of money, they can budget and plan their finances accordingly. This makes it easier to plan for expenses and save money for the future.

Benefits and Perks

Salaried employees are often eligible for a wide range of benefits and perks, such as health insurance, retirement plans, and paid time off. These benefits can be a major factor in attracting and retaining top talent in a company.

Professional Growth

Many companies provide opportunities for professional growth and development for their salaried employees. This can include training programs, mentorship opportunities, and career advancement. Salaried employees who take advantage of these opportunities can improve their skills and increase their value to the company.

The Drawbacks of Being a Salaried Employee

Long Work Hours

Salaried employees are often expected to work longer hours than their hourly counterparts. Since they are not entitled to overtime pay, employers may require them to work more than 40 hours per week without any additional compensation. This can lead to burnout and reduced productivity.

No Overtime Pay

As mentioned before, salaried employees are exempt from overtime pay. While this may not be an issue for some employees, it can be a significant loss of income for those who regularly work more than 40 hours per week.

Limited Flexibility

Salaried employees are typically expected to work set hours and be available during specific times. This can limit their flexibility in terms of scheduling and may make it difficult to balance work and personal responsibilities.

How to Properly Classify Employees as Salaried

Determine Exempt or Non-Exempt Status

Before classifying an employee as salaried, it is important to determine whether they are exempt or non-exempt. This classification is based on the employee’s job duties and salary level. Exempt employees are not entitled to overtime pay, while non-exempt employees are.

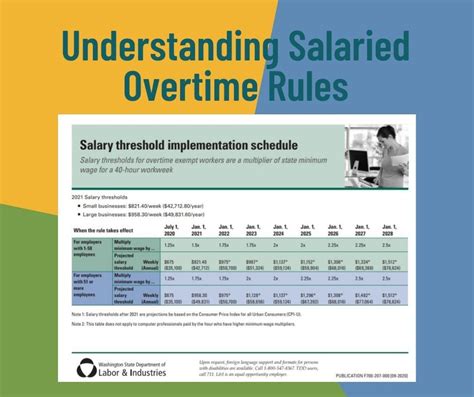

Meet Salary Thresholds

In order for an employee to be classified as exempt, they must meet certain salary thresholds. The minimum salary threshold for exempt employees is currently $35,568 per year. However, some states have higher salary thresholds, so it is important to check local regulations.

Determine Job Duties

Once an employee’s exempt status has been determined, it is important to evaluate their job duties to ensure they meet the requirements for exemption. This evaluation should be based on the employee’s primary job duties and responsibilities, rather than their job title.

Conclusion

Being a salaried employee has its pros and cons. While it provides stability and benefits, it can also lead to long work hours and reduced flexibility. It is important for employers to properly classify their employees and ensure they meet the requirements for exemption.

FAQs

What is the difference between a salaried and hourly employee?

A salaried employee receives a fixed salary regardless of the number of hours worked, while an hourly employee is paid based on the number of hours worked. Salaried employees are typically exempt from overtime pay, while hourly employees are not.

How do I know if I am exempt or non-exempt?

Your exempt or non-exempt status is determined by your job duties and salary level. Exempt employees are not entitled to overtime pay, while non-exempt employees are.

What are the minimum salary thresholds for exempt employees?

The minimum salary threshold for exempt employees is currently $35,568 per year. However, some states have higher salary thresholds, so it is important to check local regulations.