Employer Verification Of Income: Can W2S Be Requested?

When it comes to verifying an employee’s income, many employers wonder if they can request W2s. This is a common question that arises in the hiring process, particularly when employers need to verify income for loan applications or other financial purposes. In this article, we’ll explore the ins and outs of W2s and whether they can be requested as part of the employment verification process.

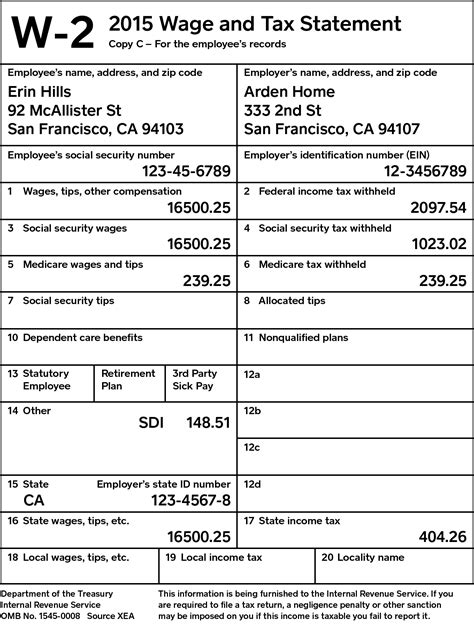

What is a W2?

A W2 is a tax form that employers use to report an employee’s annual wages and taxes withheld. It includes information about an employee’s earnings, including salary, tips, bonuses, and other compensation. Employers are required to provide their employees with a W2 form by January 31st of each year.

Can Employers Request W2s?

While employers can request W2s from employees, they are not required to do so. In fact, the Internal Revenue Service (IRS) recommends that employers do not request W2s as part of the employment verification process. Instead, employers should use other methods to verify an employee’s income, such as pay stubs or tax returns.

Why Shouldn’t Employers Request W2s?

There are several reasons why employers should avoid requesting W2s as part of the employment verification process:

- Privacy concerns: W2s contain sensitive personal information, including an employee’s Social Security number and other tax-related information. Requesting W2s can put employees at risk of identity theft or other forms of fraud.

- Legal issues: While employers are legally allowed to request W2s, they must be careful not to discriminate against employees based on their income or other protected characteristics. Requesting W2s can raise legal issues if not handled properly.

- Alternative options: There are other ways for employers to verify an employee’s income, such as pay stubs or tax returns. These options are less invasive and generally easier to obtain than W2s.

What Can Employers Request Instead of W2s?

Employers have several options for verifying an employee’s income without requesting W2s:

- Pay stubs: Employers can request that employees provide recent pay stubs to verify their income. Pay stubs typically include information about an employee’s earnings, taxes withheld, and other deductions.

- Tax returns: Employers can request that employees provide copies of their tax returns as proof of income. Tax returns include information about an employee’s earnings and deductions for the previous year.

- Bank statements: Employers can request that employees provide recent bank statements to verify their income. Bank statements can show deposits and withdrawals, which can help employers verify an employee’s income.

Conclusion

While employers can request W2s from employees, it is generally not recommended. There are several reasons why employers should avoid requesting W2s, including privacy concerns, legal issues, and the availability of alternative options. Employers can verify an employee’s income using pay stubs, tax returns, or bank statements, which are less invasive and easier to obtain than W2s.

FAQs

Can employers legally request W2s from employees?

Yes, employers are legally allowed to request W2s from employees. However, it is generally not recommended due to privacy concerns and legal issues.

What can employers use to verify an employee’s income?

Employers can use pay stubs, tax returns, or bank statements to verify an employee’s income.

Why are W2s not recommended for employment verification?

W2s contain sensitive personal information and requesting them can put employees at risk of identity theft or other forms of fraud. Additionally, there are other options available for verifying an employee’s income that are less invasive and easier to obtain.

Can employers discriminate against employees based on their income?

No, employers are not allowed to discriminate against employees based on their income. Requesting W2s as part of the employment verification process can raise legal issues if not handled properly.