Pay In Lieu Of Notice: A Closer Look At Severance Pay

When an employee is terminated from their job, they may be offered a severance package. This package can include pay in lieu of notice, which is compensation provided to the employee for the notice period they would have received if they had not been terminated. In this article, we will take a closer look at pay in lieu of notice and provide answers to commonly asked questions.

What is Pay in Lieu of Notice?

Pay in lieu of notice is a type of severance pay that compensates an employee for the notice period they would have received if they had not been terminated. This notice period varies depending on the employee’s length of service and is typically outlined in their employment contract. Pay in lieu of notice is provided as a lump sum payment and is subject to income tax and other deductions.

Why Do Employers Offer Pay in Lieu of Notice?

Employers offer pay in lieu of notice as a way to provide financial support to employees who are suddenly terminated. This can help ease the transition period for the employee and provide them with some financial stability while they search for a new job. Additionally, offering pay in lieu of notice can help prevent legal action from the terminated employee, as it satisfies the employer’s obligation to provide notice.

How is Pay in Lieu of Notice Calculated?

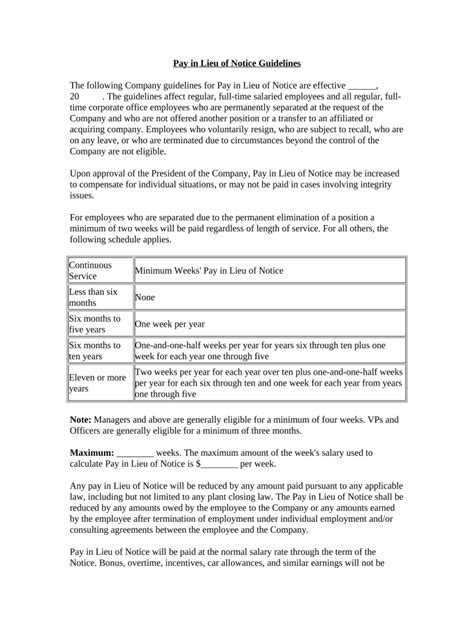

The amount of pay in lieu of notice an employee receives is typically based on their length of service with the company. For example, an employee who has worked for the company for five years may receive five weeks’ pay in lieu of notice. The exact calculation varies depending on the employer’s policies and the employee’s contract.

Is Pay in Lieu of Notice Mandatory?

Whether or not pay in lieu of notice is mandatory depends on the employee’s contract and local employment laws. In some cases, an employment contract may require the employer to provide notice or pay in lieu of notice. In other cases, local employment laws may require employers to provide a certain amount of notice or pay in lieu of notice to terminated employees.

What Are the Benefits of Pay in Lieu of Notice?

There are several benefits to providing pay in lieu of notice to terminated employees. First, it helps provide financial stability to the employee during the transition period. Second, it can help prevent legal action from the terminated employee. Finally, it can help maintain positive relationships with former employees, which can be beneficial for the employer’s reputation and future hiring needs.

What Are the Drawbacks of Pay in Lieu of Notice?

While there are benefits to providing pay in lieu of notice, there are also potential drawbacks. For example, it can be expensive for the employer to provide pay in lieu of notice, especially if the employee has a long length of service. Additionally, providing pay in lieu of notice may not be sufficient to prevent legal action from the terminated employee, especially if they feel they were terminated unfairly.

How Can Employers Mitigate the Risks of Pay in Lieu of Notice?

Employers can mitigate the risks of pay in lieu of notice by having clear policies and procedures in place for terminations. This includes having clear reasons for termination, following the proper legal and contractual requirements for notice, and providing documentation of the termination decision. Additionally, employers can consider offering additional support to terminated employees, such as outplacement services or referrals to other job opportunities.

What Should Employees Consider When Offered Pay in Lieu of Notice?

When offered pay in lieu of notice, employees should consider several factors. First, they should review their employment contract to ensure they are receiving the correct amount of pay in lieu of notice. Second, they should consider the tax implications of receiving a lump sum payment. Finally, they should review any additional benefits or support being offered by the employer, such as outplacement services or referrals to other job opportunities.

Conclusion

Pay in lieu of notice is an important aspect of severance packages for terminated employees. While it can provide financial stability and prevent legal action, it can also be expensive for employers and may not be sufficient to prevent legal action. Employers can mitigate the risks of pay in lieu of notice by having clear policies and procedures in place, while employees should review their employment contract and consider the tax implications before accepting a pay in lieu of notice offer.

FAQs

What is the notice period for pay in lieu of notice?

The notice period for pay in lieu of notice varies depending on the employee’s length of service and is typically outlined in their employment contract.

Is pay in lieu of notice subject to income tax?

Yes, pay in lieu of notice is subject to income tax and other deductions.

Can pay in lieu of notice prevent legal action from a terminated employee?

Providing pay in lieu of notice can help prevent legal action from a terminated employee, but it may not be sufficient if the employee feels they were terminated unfairly.

What can employers do to mitigate the risks of pay in lieu of notice?

Employers can mitigate the risks of pay in lieu of notice by having clear policies and procedures in place for terminations and offering additional support to terminated employees, such as outplacement services or referrals to other job opportunities.

What should employees consider when offered pay in lieu of notice?

When offered pay in lieu of notice, employees should review their employment contract, consider the tax implications, and review any additional benefits or support being offered by the employer.