Sample Retirement Letter: Notifying Your Employer

Retirement is a significant milestone in anyone’s life, and it’s essential to inform your employer of your plans to retire. Writing a retirement letter can be an emotional and challenging task, but it’s a necessary step to ensure a smooth transition and maintain a positive relationship with your employer. Here’s a step-by-step guide on how to write a retirement letter and what to include in it.

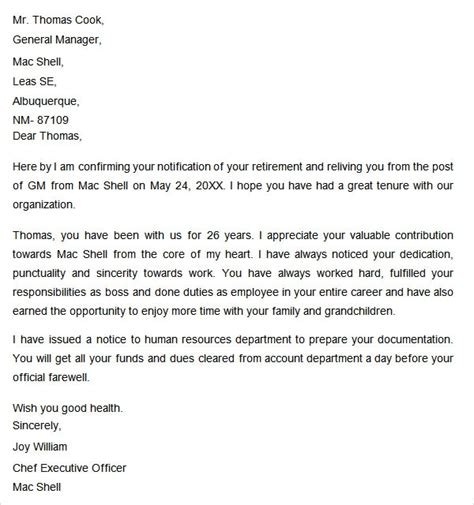

1. Start with a proper salutation

Begin your retirement letter by addressing your employer or supervisor with a formal salutation. Use their full name and job title, if possible. For example, “Dear Mr. John Smith, Chief Executive Officer.”

2. Express gratitude and appreciation

Express your gratitude and appreciation for the opportunities and experiences you’ve had during your tenure with the company. Thank your employer for their support and guidance throughout your career. This will set a positive tone for the rest of the letter.

3. State your intention to retire

Be clear and direct in stating your intention to retire. Include the date you plan to retire and the reason for your retirement, if you wish. For example, “I am writing to inform you that I plan to retire on June 30, 2022, after 25 years of dedicated service to the company.”

4. Offer to assist with the transition

Offer to assist with the transition process and ensure a smooth handover of your duties and responsibilities. This may include training your replacement, documenting your work processes, or providing guidance to your colleagues. This gesture will show your commitment to the company and your willingness to help your employer in any way possible.

5. Provide your contact information

Include your contact information in the retirement letter, such as your phone number, email address, and home address. This will allow your employer to stay in touch with you if they need to reach out to you regarding any work-related matters.

6. Express your best wishes

End the letter on a positive note by expressing your best wishes for the company’s future success. Thank your employer once again and express your gratitude for the time you’ve spent working with them. For example, “I wish you and the company all the best in the future, and I am grateful for the opportunity to have been a part of this organization.”

7. Proofread and edit

Before sending your retirement letter, make sure to proofread and edit it for any errors or typos. Ensure that the tone is professional, respectful, and appreciative. You may also want to ask a trusted colleague or friend to review the letter and provide feedback.

8. Submit the letter

Submit the retirement letter to your employer or supervisor in person or via email, depending on your company’s policies. Make sure to follow up with your employer to confirm that they received the letter and discuss any details regarding your retirement.

9. FAQs

Q: When should I inform my employer of my retirement?

A: It’s recommended to inform your employer of your retirement at least two to three months in advance, depending on your company’s policies and procedures.

Q: Do I need to provide a reason for my retirement?

A: No, you’re not obligated to provide a reason for your retirement. However, you may choose to do so if you wish.

Q: Should I include my retirement plans in the letter?

A: It’s not necessary to include your retirement plans in the letter, but you may choose to do so if you wish. For example, if you plan to travel or pursue a new hobby, you can mention it briefly in the letter.

Q: Should I offer to work part-time after my retirement?

A: It’s up to you to decide if you want to offer to work part-time after your retirement. However, make sure to discuss this with your employer beforehand and agree on the terms and conditions of the arrangement.

Q: What should I do after submitting my retirement letter?

A: After submitting your retirement letter, follow up with your employer to confirm that they received the letter and discuss any details regarding your retirement. You may also want to start planning your retirement finances and lifestyle and consult with a financial advisor if necessary.