Unemployment Benefits Eligibility: Your Guide

Unemployment benefits are a lifeline for those who have lost their jobs. They provide financial support to help you get by until you find your next job. However, not everyone is eligible for unemployment benefits. The eligibility requirements vary by state, and it can be confusing to navigate the system. In this guide, we will walk you through the eligibility requirements for unemployment benefits.

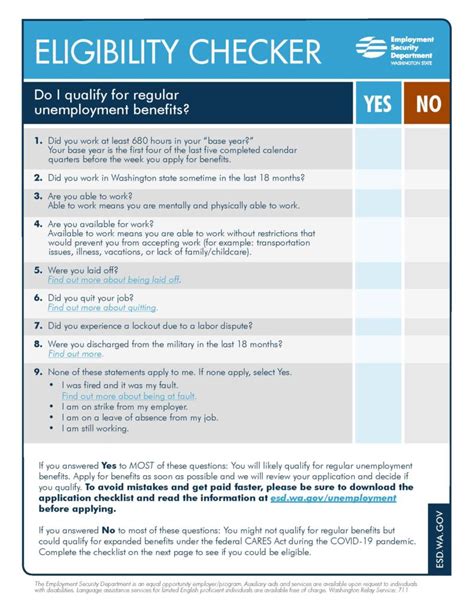

Who is Eligible for Unemployment Benefits?

To be eligible for unemployment benefits, you must meet the following criteria:

- You must have lost your job through no fault of your own.

- You must have earned enough wages to qualify for benefits.

- You must be able and available to work.

- You must be actively seeking employment.

- You must meet the specific eligibility requirements of your state.

Lost Job Through No Fault of Your Own

You must have lost your job through no fault of your own to be eligible for unemployment benefits. This means that if you quit your job or were fired for misconduct, you will not be eligible for benefits.

Earned Enough Wages to Qualify for Benefits

You must have earned enough wages to qualify for benefits. Each state has its own formula for calculating eligibility, but generally, you must have earned a certain amount of wages in a specific time period.

Able and Available to Work

You must be able and available to work to be eligible for benefits. This means that you must be physically and mentally able to work and must be actively seeking employment.

Actively Seeking Employment

You must be actively seeking employment to be eligible for benefits. This means that you must be applying for jobs, attending job fairs, and networking with potential employers.

Meet Specific Eligibility Requirements of Your State

Each state has its own eligibility requirements for unemployment benefits. You must meet the specific requirements of your state to be eligible for benefits. Check with your state’s unemployment office for more information.

Who is Not Eligible for Unemployment Benefits?

There are certain situations in which you may not be eligible for unemployment benefits. These include:

- You quit your job without good cause.

- You were fired for misconduct.

- You are self-employed or a freelancer.

- You are not a citizen or legal resident of the United States.

- You are currently incarcerated.

Conclusion

Unemployment benefits can be a vital source of support for those who have lost their jobs. However, eligibility requirements can be complex and vary by state. To be eligible for benefits, you must have lost your job through no fault of your own, earned enough wages to qualify, be able and available to work, actively seeking employment, and meet the specific eligibility requirements of your state. If you are unsure of your eligibility, contact your state’s unemployment office for more information.

Frequently Asked Questions

1. How do I apply for unemployment benefits?

You can apply for unemployment benefits online or in-person at your state’s unemployment office. Check with your state for specific instructions.

2. How long can I receive unemployment benefits?

The length of time you can receive unemployment benefits varies by state and depends on factors such as your work history and the state of the economy. Check with your state for more information.

3. What happens if I am denied unemployment benefits?

If you are denied unemployment benefits, you can appeal the decision. Check with your state for specific instructions on the appeals process.

4. Can I work part-time while receiving unemployment benefits?

Yes, you can work part-time while receiving unemployment benefits. However, your earnings may affect the amount of benefits you receive. Check with your state for more information.

5. Do I have to pay taxes on unemployment benefits?

Yes, unemployment benefits are taxable income. You will receive a 1099-G form at the end of the year indicating the amount of benefits you received.