When To Expect Your First And Last Paycheck: A Comprehensive Guide

Getting paid is one of the most important aspects of any job. Whether you’re starting a new job or just curious about your paycheck, it’s essential to know when you can expect your first and last paycheck. In this guide, we’ll cover everything you need to know about paychecks, from calculating your salary to understanding your paycheck deductions.

Table of Contents

- Calculating Your Salary

- Hourly vs. Salary Pay

- Overtime Pay

- Bonus Pay

- Commission Pay

- When to Expect Your First Paycheck

- New Hire Paperwork

- Pay Periods

- Direct Deposit

- Paper Checks

- Delays in Payment

- Understanding Your Paycheck

- Gross Pay vs. Net Pay

- Paycheck Deductions

- Federal Income Tax

- State Income Tax

- Social Security Tax

- Medicare Tax

- Other Deductions

- When to Expect Your Last Paycheck

- Resignation or Termination

- Severance Pay

- Unpaid Wages

- Paycheck FAQs

- What is the difference between gross pay and net pay?

- How do I calculate my overtime pay?

- What is a pay period?

- What are common paycheck deductions?

- What happens if my paycheck is delayed?

- What is severance pay?

- What are my rights if I don’t receive my last paycheck?

- Conclusion

Calculating Your Salary

Before we dive into when you can expect your first and last paycheck, it’s important to understand how your salary is calculated. Here are some basic terms you should know:

Hourly vs. Salary Pay

Hourly pay is when you’re paid based on the number of hours you work. Salary pay is when you’re paid a fixed amount each pay period, regardless of how many hours you work.

Example: John is paid $15 per hour and works 40 hours per week. His gross pay for the week is $600 (40 hours x $15 per hour).

Overtime Pay

Overtime pay is when you’re paid extra for working more than 40 hours in a week.

Example: Sarah is paid $20 per hour and works 45 hours in a week. For the first 40 hours, she’s paid her regular rate of $20 per hour. For the extra 5 hours, she’s paid time-and-a-half, or $30 per hour. Her gross pay for the week is $950 (40 hours x $20 per hour) + (5 hours x $30 per hour).

Bonus Pay

Bonus pay is additional pay you receive on top of your regular salary or hourly pay.

Example: Lisa’s employer offers her a $500 bonus for meeting her sales quota for the month. Her gross pay for the month is $3,000 (her regular salary) + $500 (the bonus).

Commission Pay

Commission pay is when you’re paid a percentage of the sales you make.

Example: Mark is a real estate agent and earns a 3% commission on the sale of a $300,000 house. His commission is $9,000 (3% x $300,000).

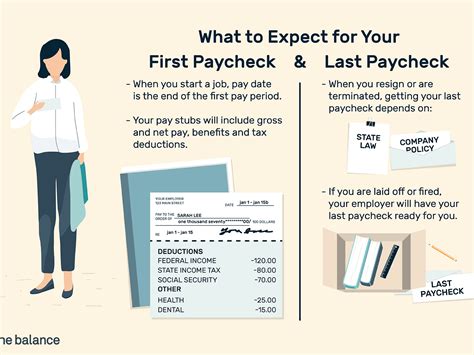

When to Expect Your First Paycheck

Now that you understand how your salary is calculated, let’s talk about when you can expect your first paycheck.

New Hire Paperwork

Before you can receive your first paycheck, you’ll need to complete new hire paperwork. This includes filling out tax forms, direct deposit information, and other forms required by your employer.

Pay Periods

Pay periods are the time frames for which you’re paid. These can be weekly, bi-weekly, semi-monthly, or monthly. Your employer will let you know the pay period for your job.

Direct Deposit

Direct deposit is when your paycheck is automatically deposited into your bank account. This is usually the fastest and most convenient way to receive your paycheck.

Paper Checks

If you don’t have a bank account or prefer to receive a paper check, your employer will provide you with a physical check on payday.

Delays in Payment

Paychecks can be delayed for a variety of reasons, such as holidays or processing issues. If you don’t receive your paycheck on time, contact your employer to find out when you can expect payment.

Understanding Your Paycheck

Once you receive your first paycheck, it’s important to understand what all the numbers mean. Here are some key terms to know:

Gross Pay vs. Net Pay

Gross pay is the amount of money you earned before any deductions were taken out. Net pay is the amount of money you actually receive after deductions.

Paycheck Deductions

Paycheck deductions are the amounts taken out of your paycheck for taxes, benefits, and other expenses. Here are some common paycheck deductions:

Federal Income Tax

Federal income tax is a tax on your income that’s paid to the federal government. The amount of federal income tax you pay depends on your income level and filing status.

State Income Tax

State income tax is a tax on your income that’s paid to your state government. Not all states have an income tax.

Social Security Tax

Social Security tax is a tax on your income that pays for Social Security benefits. Both you and your employer pay a portion of the Social Security tax.

Medicare Tax

Medicare tax is a tax on your income that pays for Medicare benefits. Both you and your employer pay a portion of the Medicare tax.

Other Deductions

Other deductions may include health insurance premiums, retirement contributions, and other benefits offered by your employer.

When to Expect Your Last Paycheck

If you leave your job, you’ll be entitled to a final paycheck. Here’s what you need to know:

Resignation or Termination

If you resign or are terminated from your job, you’re entitled to receive your final paycheck on your last day of work or within a certain number of days, depending on state law.

Severance Pay

Severance pay is additional pay you may receive when you leave a job, usually as part of a layoff or downsizing. The amount of severance pay you receive depends on your employer’s policy.

Unpaid Wages

If you’re not paid for all the hours you worked, you may be entitled to unpaid wages. Contact your state labor department for assistance.

Paycheck FAQs

What is the difference between gross pay and net pay?

Gross pay is the amount of money you earned before any deductions were taken out. Net pay is the amount of money you actually receive after deductions.

How do I calculate my overtime pay?

To calculate your overtime pay, multiply your regular hourly rate by 1.5 and then multiply that by the number of overtime hours worked.

What is a pay period?

A pay period is the time frame for which you’re paid. These can be weekly, bi-weekly, semi-monthly, or monthly.

What are common paycheck deductions?

Common paycheck deductions include federal and state income tax, Social Security tax, Medicare tax, and other benefits offered by your employer.

What happens if my paycheck is delayed?

If your paycheck is delayed, contact your employer to find out when you can expect payment.

What is severance pay?

Severance pay is additional pay you may receive when you leave a job, usually as part of a layoff or