Calculating Total Assets: Examples And Methods

Calculating total assets is an important step in financial analysis and planning. It provides a snapshot of a company’s financial health and helps investors and stakeholders make informed decisions. In this article, we will explore various examples and methods of calculating total assets.

1. Definition of Total Assets

Total assets refer to the sum of all tangible and intangible assets owned by a company. Tangible assets include cash, inventory, property, and equipment, while intangible assets include patents, trademarks, and goodwill. It is important to consider both types of assets when calculating the total.

2. Examples of Tangible Assets

2.1 Cash

Cash is the most liquid asset and includes currency, coins, and funds in bank accounts. It is readily available for use and can be easily valued.

2.2 Inventory

Inventory refers to the goods a company holds for sale or use in its operations. This can include raw materials, work-in-progress, and finished goods. It is important to value inventory accurately to determine its contribution to total assets.

2.3 Property

Property includes land, buildings, and other physical assets owned by the company. These assets are usually valued at their purchase cost or fair market value.

2.4 Equipment

Equipment refers to machinery, vehicles, and other tools used in the company’s operations. These assets are typically depreciated over time to reflect their decrease in value.

3. Examples of Intangible Assets

3.1 Patents

Patents are exclusive rights granted to inventors for their inventions. They have a definite lifespan and can be valued based on their potential future earnings or market value.

3.2 Trademarks

Trademarks are symbols, logos, or names that distinguish a company’s products or services. They have value in building brand recognition and can be valued based on their market reputation.

3.3 Goodwill

Goodwill represents the value of a company’s reputation, customer base, and other intangible assets that cannot be separately identified. It is typically calculated as the difference between the purchase price of an acquired company and the fair market value of its net assets.

4. Methods of Calculating Total Assets

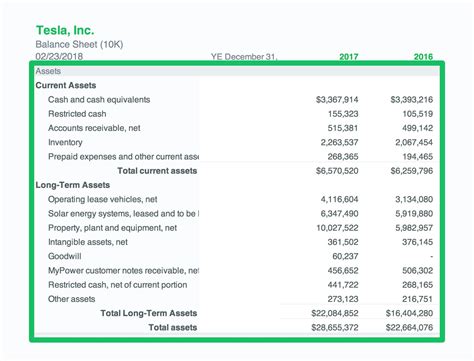

4.1 Balance Sheet Method

The balance sheet method is the most common and straightforward way to calculate total assets. It involves adding up all the assets listed on a company’s balance sheet, including current assets, long-term assets, and intangible assets.

4.2 Net Asset Value Method

The net asset value method calculates total assets by subtracting total liabilities from total equity. This method provides a measure of the company’s net worth and is commonly used in the real estate and investment industries.

4.3 Income Approach Method

The income approach method calculates total assets based on the present value of expected future cash flows generated by the company. This method is commonly used in business valuation and requires financial forecasting and discounting techniques.

5. Conclusion

Calculating total assets is an essential part of financial analysis. It provides valuable insights into a company’s financial position and helps investors and stakeholders make informed decisions. By understanding the examples and methods discussed in this article, you can confidently analyze and interpret total assets in your financial analysis.

FAQs

Q1: Why is calculating total assets important?

A1: Calculating total assets helps investors and stakeholders assess a company’s financial health and make informed decisions. It provides a snapshot of the company’s resources and can indicate its ability to generate future cash flows.

Q2: Can intangible assets be included in the calculation of total assets?

A2: Yes, intangible assets such as patents, trademarks, and goodwill are included in the calculation of total assets. They have value and contribute to the overall worth of the company.

Q3: What is the difference between tangible and intangible assets?

A3: Tangible assets are physical assets that can be seen and touched, such as cash, inventory, and property. Intangible assets, on the other hand, are non-physical assets such as patents, trademarks, and goodwill.

Q4: How often should total assets be calculated?

A4: Total assets are typically calculated at the end of each accounting period, such as quarterly or annually. This allows for regular monitoring of the company’s financial position.