Ratio Calculation: How To Calculate With Example

Calculating ratios is an essential skill for anyone who wants to analyze data and make informed decisions. Ratios can be used to compare different values, such as sales to expenses, assets to liabilities, or debt to equity. In this article, we’ll explain what ratios are, how to calculate them, and provide examples to help you understand the process.

What are Ratios?

A ratio is a mathematical expression that shows the relationship between two or more values. Ratios are often expressed as a fraction, such as 2/3, or as a percentage, such as 50%. They are used to compare different quantities and provide meaningful insights into the financial health and performance of a business or organization.

Types of Ratios

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. They indicate whether a company has enough cash or other liquid assets to pay its bills as they come due. Examples of liquidity ratios include:

- Current Ratio

- Quick Ratio

- Cash Ratio

Profitability Ratios

Profitability ratios measure a company’s ability to generate profits from its operations. They indicate whether a company is earning a sufficient return on its investments. Examples of profitability ratios include:

- Gross Profit Margin

- Net Profit Margin

- Return on Investment (ROI)

Efficiency Ratios

Efficiency ratios measure a company’s ability to manage its assets and liabilities. They indicate whether a company is using its resources effectively to generate revenue. Examples of efficiency ratios include:

- Asset Turnover Ratio

- Inventory Turnover Ratio

- Accounts Receivable Turnover Ratio

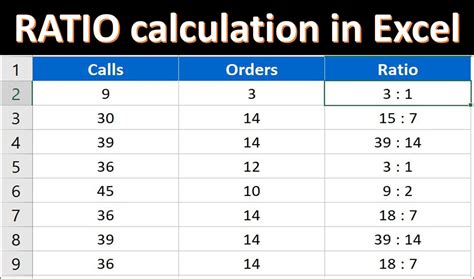

How to Calculate Ratios

Calculating ratios is a simple process that involves dividing one value by another. Let’s take a look at how to calculate the current ratio:

Current Ratio = Current Assets ÷ Current Liabilities

To calculate the current ratio, you need to know the total value of a company’s current assets and current liabilities. Current assets include cash, accounts receivable, and inventory, while current liabilities include accounts payable and short-term debt.

For example, let’s say that XYZ Company has current assets of $100,000 and current liabilities of $50,000. To calculate the current ratio, you would divide $100,000 by $50,000, which gives you a ratio of 2:1. This means that XYZ Company has two dollars of current assets for every dollar of current liabilities.

Examples of Ratio Calculations

Example 1: Gross Profit Margin

The gross profit margin is a profitability ratio that measures the percentage of revenue that exceeds the cost of goods sold. It is calculated by dividing gross profit by revenue.

Gross Profit Margin = Gross Profit ÷ Revenue x 100%

Let’s say that ABC Company has a gross profit of $500,000 and revenue of $1,000,000. To calculate the gross profit margin, you would divide $500,000 by $1,000,000, which gives you a ratio of 0.5. Multiply this by 100 to get a percentage, and the gross profit margin for ABC Company is 50%. This means that ABC Company earns 50 cents in gross profit for every dollar of revenue.

Example 2: Quick Ratio

The quick ratio is a liquidity ratio that measures a company’s ability to pay its bills without relying on inventory. It is calculated by dividing the sum of cash, accounts receivable, and short-term investments by current liabilities.

Quick Ratio = (Cash + Accounts Receivable + Short-term Investments) ÷ Current Liabilities

Let’s say that XYZ Company has cash of $50,000, accounts receivable of $100,000, short-term investments of $25,000, and current liabilities of $75,000. To calculate the quick ratio, you would add the cash, accounts receivable, and short-term investments to get $175,000, then divide by $75,000 to get a ratio of 2.33:1. This means that XYZ Company has $2.33 in liquid assets for every dollar of current liabilities.

Conclusion

Ratio calculations are an essential tool for analyzing the financial health and performance of a business or organization. By understanding how to calculate different types of ratios, you can gain valuable insights into a company’s liquidity, profitability, and efficiency. Whether you’re an investor, business owner, or financial analyst, mastering the art of ratio calculation is a crucial skill that can help you make informed decisions and achieve your financial goals.

FAQs

What are the different types of ratios?

There are three main types of ratios: liquidity ratios, profitability ratios, and efficiency ratios. Liquidity ratios measure a company’s ability to meet its short-term obligations, profitability ratios measure a company’s ability to generate profits from its operations, and efficiency ratios measure a company’s ability to manage its assets and liabilities.

How do you calculate ratios?

Calculating ratios is a simple process that involves dividing one value by another. To calculate the current ratio, for example, you need to divide current assets by current liabilities. To calculate the gross profit margin, you need to divide gross profit by revenue. Each type of ratio has its own formula, which you can easily find online or in financial textbooks.

Why are ratios important?

Ratios are important because they provide valuable insights into a company’s financial health and performance. By comparing different values, ratios can help you identify strengths and weaknesses, as well as opportunities for growth. They are also useful for making informed decisions about investments, business operations, and financial planning.