Net Sales Definition: Importance, How-To, Faq

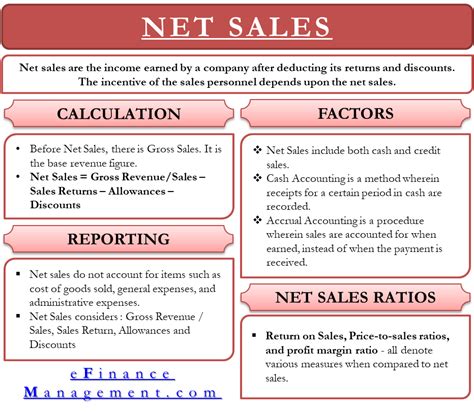

Net sales is a financial metric that represents the total revenue generated by a company after deducting returns, discounts, and allowances. It is an essential measure in evaluating a company’s performance and financial health. In this article, we will explore the importance of net sales, how to calculate it, and answer frequently asked questions related to this topic.

Importance of Net Sales

Net sales provide valuable insights into a company’s ability to generate revenue and effectively manage its sales operations. Here are some reasons why net sales is important:

- Financial Performance Assessment

- Profitability Analysis

- Comparison with Competitors

- Forecasting and Planning

- Determining Sales Commission

- Investor Confidence

- Financial Statement Preparation

- Tax Calculation

Financial Performance Assessment

Net sales is a key metric used to assess a company’s financial performance. It reflects the company’s ability to generate revenue from its core operations. By analyzing the trend of net sales over time, stakeholders can evaluate the growth or decline of the business.

Profitability Analysis

Net sales is a crucial component in calculating profitability ratios such as gross profit margin and net profit margin. These ratios help determine the efficiency of a company’s operations and its ability to generate profits.

Comparison with Competitors

Net sales allow companies to benchmark their performance against competitors in the same industry. By comparing net sales figures, companies can identify areas where they are outperforming or underperforming their peers.

Forecasting and Planning

Net sales data is essential for forecasting future sales and planning business strategies. By analyzing historical net sales patterns, companies can make informed decisions regarding pricing, marketing, and resource allocation.

Determining Sales Commission

Net sales is used to calculate sales commissions for employees. By basing commissions on net sales, companies can incentivize their sales teams to focus on generating profitable revenue.

Investor Confidence

Net sales figures play a significant role in building investor confidence. Investors rely on strong net sales growth as an indicator of a company’s potential for profitability and future success.

Financial Statement Preparation

Net sales is a vital component of financial statements such as the income statement. It provides a clear representation of a company’s revenue generation after accounting for returns and discounts.

Tax Calculation

Net sales figures are used in calculating taxes owed by a company. It is crucial for accurate tax reporting and compliance with tax regulations.

How to Calculate Net Sales

The formula to calculate net sales is:

Net Sales = Gross Sales – Returns, Discounts, and Allowances

Frequently Asked Questions (FAQ)

Q: What is the difference between gross sales and net sales?

A: Gross sales represent the total revenue generated by a company before deducting any returns, discounts, or allowances. Net sales, on the other hand, are the revenue remaining after these deductions.

Q: How often should net sales be calculated?

A: Net sales should be calculated regularly, typically on a monthly, quarterly, and annual basis. This allows for timely monitoring of sales performance and financial analysis.

Q: Can net sales be negative?

A: Yes, net sales can be negative if the amount of returns, discounts, and allowances exceeds the gross sales. Negative net sales indicate a loss in revenue.

Q: What factors can impact net sales?

A: Several factors can impact net sales, including changes in pricing, customer demand, competition, economic conditions, and marketing strategies.

Q: How can a company increase its net sales?

A: To increase net sales, a company can focus on improving marketing and sales strategies, expanding the customer base, enhancing product offerings, and providing excellent customer service.

Q: Are net sales the same as net income?

A: No, net sales and net income are different. Net sales represent the revenue generated from sales activities, while net income is the final profit or loss after deducting all expenses from the net sales.

Q: Is net sales the same as revenue?

A: Yes, net sales and revenue are often used interchangeably. Both terms refer to the total amount of money generated from the sale of goods or services.

Q: Can net sales be manipulated?

A: It is possible for companies to manipulate net sales figures through unethical practices such as channel stuffing or fictitious sales. However, such practices are illegal and can have severe consequences.

Q: How can net sales be used for financial analysis?

A: Net sales can be used in various financial analysis techniques such as ratio analysis, trend analysis, and benchmarking. It helps evaluate a company’s sales performance, profitability, and market position.

Q: Are net sales reported differently in different industries?

A: While the concept of net sales remains the same across industries, reporting requirements may vary. Companies should adhere to the specific accounting standards and industry regulations applicable to their sector.

Conclusion

Net sales is a crucial financial metric that provides insights into a company’s revenue generation and financial performance. By calculating net sales accurately and analyzing the data, businesses can make informed decisions and plan for future growth. Understanding the importance of net sales and how to calculate it is essential for financial analysis, forecasting, and overall business success.

*This article is for informational purposes only and should not be considered financial or legal advice. Consult with a professional accountant or financial advisor for specific guidance related to your business.