Understanding Roi: Definition, Formula & Calculation

ROI, or Return on Investment, is a key financial metric used to evaluate the profitability and efficiency of an investment. It measures the return or profit generated relative to the cost of the investment. ROI is widely used by businesses and investors to assess the success of their investments and make informed decisions.

What is ROI?

ROI is a financial ratio that compares the net profit from an investment to the initial cost of the investment. It is expressed as a percentage and provides insights into the profitability and efficiency of an investment.

Why is ROI important?

ROI is important because it helps businesses and investors determine the financial viability of an investment. It allows them to assess the profitability of different investment opportunities and make informed decisions. ROI also helps in comparing the performance of different investments and evaluating their effectiveness.

How to calculate ROI?

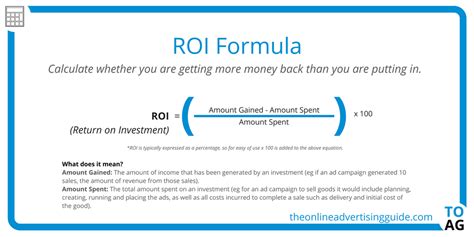

The formula for calculating ROI is:

ROI = (Net Profit / Cost of Investment) x 100%

Let’s break down the formula:

- Net Profit: This is the total profit earned from the investment, which is calculated by subtracting the cost of investment from the total revenue generated.

- Cost of Investment: This is the total cost incurred to acquire and maintain the investment, including purchase price, transaction fees, and any additional costs.

Example of calculating ROI

Let’s say you invested $10,000 in a stock and sold it a year later for $12,000. During that year, you received $500 in dividends. To calculate the ROI, you would follow these steps:

- Calculate the net profit: Net Profit = Total Revenue – Cost of Investment

- Calculate the total revenue: Total Revenue = Selling Price + Dividends

- Calculate the ROI: ROI = (Net Profit / Cost of Investment) x 100%

Using the example above:

- Net Profit = ($12,000 + $500) – $10,000 = $2,500

- Cost of Investment = $10,000

- ROI = ($2,500 / $10,000) x 100% = 25%

Interpreting ROI

Understanding the ROI value is crucial to interpreting the success of an investment. A positive ROI indicates a profitable investment, while a negative ROI suggests a loss. The higher the ROI, the more profitable the investment is considered to be.

Factors affecting ROI

Several factors can influence the ROI of an investment:

- Timeframe: The length of time an investment is held can impact the ROI. Longer holding periods may result in higher returns.

- Risk: Riskier investments may have higher potential returns but also higher chances of losses, affecting the ROI.

- Expenses: Higher expenses associated with an investment can reduce the net profit and lower the ROI.

- Market conditions: Economic factors and market conditions can significantly impact the ROI of investments.

Advantages of ROI

ROI offers several advantages for businesses and investors:

- Performance evaluation: ROI helps assess the performance of investments and identify the most profitable opportunities.

- Decision making: ROI provides valuable insights for making informed investment decisions.

- Comparison: ROI allows for easy comparison of different investments to determine the most favorable options.

- Goal setting: ROI helps set realistic financial goals and targets for businesses and individuals.

Conclusion

ROI is a vital financial metric that enables businesses and investors to assess the profitability and efficiency of investments. By calculating ROI, one can evaluate the success of an investment and make informed decisions. Understanding the factors that affect ROI is essential for interpreting and comparing the performance of different investments.

FAQs

1. What is a good ROI?

A good ROI is subjective and depends on various factors, such as the industry, risk tolerance, and investment goals. Generally, a positive ROI above the cost of capital is considered good.

2. Can ROI be negative?

Yes, ROI can be negative, indicating a loss on the investment. It is important to analyze the reasons for the negative ROI and consider adjusting investment strategies if necessary.

3. How can ROI be improved?

ROI can be improved by increasing the net profit or reducing the cost of investment. This can be achieved through strategies such as increasing sales revenue, reducing expenses, or optimizing operational efficiencies.

4. Is ROI the only measure of investment success?

No, ROI is one of the measures of investment success, but it should not be the sole metric considered. Other factors, such as risk, payback period, and qualitative factors, should also be taken into account.