New York State Minimum Wage Rates: Current Information

As an employee in the state of New York, it is important to know the current minimum wage rates that apply to your job. The minimum wage is the lowest amount an employer can legally pay their employees for their work. In this post, we will cover all the information you need to know about the minimum wage rates in New York State, including when and how they are updated, how they vary based on location and industry, and more.

What is the Minimum Wage in New York State?

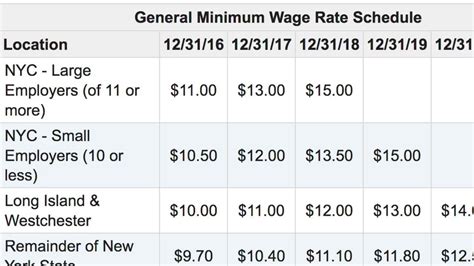

The minimum wage in New York State varies based on factors such as location, industry, and employer size. As of December 31, 2020, the minimum wage rates in New York State are as follows:

- $15.00 per hour in New York City for employers with 11 or more employees

- $14.00 per hour in Long Island and Westchester for employers with 11 or more employees

- $12.50 per hour in the rest of New York State for employers with 11 or more employees

- $15.00 per hour for all employers in New York City and Long Island

- $14.00 per hour for all employers in Westchester

- $12.50 per hour for all employers in the rest of New York State

When Are Minimum Wage Rates Updated in New York State?

The minimum wage rates in New York State are updated on an annual basis. The rates are adjusted based on increases in the cost of living, as measured by the Consumer Price Index (CPI). The updated rates usually take effect on December 31st of each year.

How Do Minimum Wage Rates Vary Based on Industry?

The minimum wage rates in New York State can vary based on the industry in which an employee works. For example, the minimum wage rate for fast food workers in New York City is $15.00 per hour, while the minimum wage rate for tipped workers in the hospitality industry is $10.00 per hour. It is important to check with your employer or the New York State Department of Labor to determine the minimum wage rate that applies to your specific job and industry.

Who is Exempt from Minimum Wage Requirements in New York State?

While most employees in New York State are entitled to receive the minimum wage, there are some exemptions. The following types of employees are exempt from minimum wage requirements:

- Most salaried employees who work in a professional, administrative, or executive capacity

- Outside salespersons

- Volunteers of non-profit organizations

- Babysitters and companions for the elderly or disabled

What Should I Do If My Employer is Not Paying Me the Minimum Wage?

If you believe that your employer is not paying you the minimum wage, you can file a complaint with the New York State Department of Labor. The Department of Labor will investigate your complaint and take appropriate action if necessary. It is important to keep records of your hours worked and your pay to support your complaint.

Conclusion

Knowing the current minimum wage rates in New York State is important for all employees. The rates vary based on location, industry, and employer size, and are updated on an annual basis. If you believe that your employer is not paying you the minimum wage, you can file a complaint with the New York State Department of Labor. By understanding your rights as an employee, you can ensure that you are being paid fairly for your work.

FAQs

Q: What is the current minimum wage in New York State?

A: As of December 31, 2020, the minimum wage rates in New York State are $15.00 per hour for employers with 11 or more employees in New York City, $14.00 per hour for employers with 11 or more employees in Long Island and Westchester, and $12.50 per hour for employers with 11 or more employees in the rest of New York State.

Q: When are minimum wage rates updated in New York State?

A: Minimum wage rates in New York State are updated on an annual basis, usually taking effect on December 31st of each year.

Q: Who is exempt from minimum wage requirements in New York State?

A: Some employees, such as most salaried employees who work in a professional, administrative, or executive capacity, outside salespersons, and volunteers of non-profit organizations, are exempt from minimum wage requirements in New York State.

Q: What should I do if my employer is not paying me the minimum wage?

A: If you believe that your employer is not paying you the minimum wage, you can file a complaint with the New York State Department of Labor and keep records of your hours worked and pay received to support your complaint.