Annual Net Income: Definition & Calculation Guide

When it comes to personal finance and business accounting, understanding your annual net income is crucial. Whether you are an individual managing your personal finances or a business owner evaluating the financial health of your company, knowing how to calculate your annual net income is essential. In this guide, we will define annual net income and provide you with step-by-step instructions on how to calculate it.

What is Annual Net Income?

Annual net income, also known as net profit or net earnings, is the amount of money a person or a business earns after deducting all expenses and taxes from the total revenue generated in a year. It is a measure of financial performance and indicates the profitability of an individual or a company.

Why is Annual Net Income Important?

Understanding your annual net income is important for several reasons:

- Financial Planning: Knowing your net income helps you create a budget, set financial goals, and make informed decisions about saving, investing, and spending.

- Business Performance Evaluation: For business owners, net income is a key indicator of the company’s financial health and profitability. It helps in evaluating the success of the business and making strategic decisions.

- Tax Calculation: Net income is used to determine the amount of income tax you owe to the government. It is an essential component in calculating your tax liability.

How to Calculate Annual Net Income

To calculate your annual net income, follow these steps:

Step 1: Determine Total Revenue

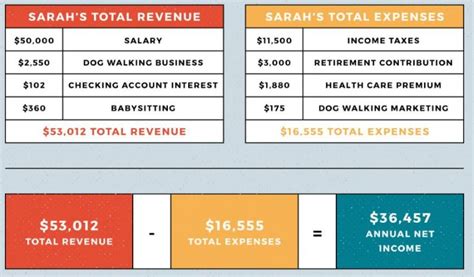

The first step in calculating annual net income is to determine your total revenue. Total revenue includes all the money earned from sales, services, or any other sources of income. For businesses, it is the sum of all sales revenue generated in a year. For individuals, it includes salary, rental income, investment income, and any other sources of income.

Step 2: Subtract Cost of Goods Sold (COGS)

If you are a business owner, subtract the cost of goods sold (COGS) from your total revenue. COGS includes the direct costs associated with producing or delivering your products or services. It includes the cost of raw materials, manufacturing costs, and any other costs directly related to the production process.

Step 3: Subtract Operating Expenses

Next, subtract your operating expenses from the result obtained in Step 2. Operating expenses are the costs incurred to run your business or manage your personal finances. They include expenses such as rent, utilities, salaries, marketing expenses, travel expenses, and any other costs necessary to operate your business or manage your personal finances.

Step 4: Deduct Taxes

After subtracting operating expenses, deduct any taxes owed, such as income tax or business taxes. The tax rate will depend on your income level or the tax laws applicable to your business.

Step 5: Calculate Net Income

The final step is to calculate your net income by subtracting taxes from the result obtained in Step 3. This is the amount of money you or your business has earned after deducting all expenses and taxes.

Conclusion

Annual net income is a vital financial metric for individuals and businesses. It helps in financial planning, evaluating business performance, and calculating taxes. By following the steps outlined in this guide, you can accurately calculate your annual net income and gain a better understanding of your financial situation.

Frequently Asked Questions (FAQs)

1. What is the difference between gross income and net income?

Gross income is the total revenue earned before deducting any expenses, taxes, or deductions. Net income, on the other hand, is the amount of money earned after subtracting all expenses and taxes from the total revenue.

2. Can net income be negative?

Yes, net income can be negative, indicating a loss rather than a profit. This can happen when expenses exceed revenue.

3. How often should I calculate my net income?

It is recommended to calculate your net income annually for personal finance management. For businesses, net income should be calculated at least on a monthly or quarterly basis to monitor financial performance.

4. What other financial ratios can be calculated using net income?

Net income is used to calculate various financial ratios, such as the profit margin, return on investment (ROI), and earnings per share (EPS). These ratios provide insights into the profitability and efficiency of a business.