Payment Terms: Definition And Invoicing Importance

Payment terms refer to the agreed-upon conditions between a buyer and a seller regarding when and how payment should be made for goods or services. These terms are typically outlined in an invoice or contract and specify the payment due date, method of payment, and any applicable late fees or discounts. Understanding and adhering to payment terms is crucial for both buyers and sellers to ensure smooth financial transactions and maintain healthy business relationships.

Importance of Payment Terms

Clear and fair payment terms are essential for the financial stability and success of any business. They provide a framework for managing cash flow, reducing payment delays, and avoiding disputes. Here are some key reasons why payment terms are important:

- Predictable Cash Flow: Defined payment terms help businesses forecast their cash inflows and outflows more accurately. By knowing when payments are due, companies can better plan their expenses, investments, and growth strategies.

- Improved Financial Planning: Payment terms allow businesses to plan their financial resources effectively. They can allocate funds for future purchases, negotiate better terms with suppliers, and make informed decisions about borrowing or investing.

- Reduced Payment Delays: Clear payment terms with explicit due dates encourage prompt payment from buyers. This reduces the risk of late or missed payments, which can strain the seller’s cash flow and disrupt their operations.

- Enhanced Customer Relationships: By setting fair and transparent payment terms, businesses can build trust and credibility with their customers. This fosters stronger relationships, customer loyalty, and repeat business.

- Dispute Prevention: Well-defined payment terms can help prevent misunderstandings and disputes between buyers and sellers. By clearly stating the payment expectations, terms, and conditions upfront, both parties have a clear understanding of their obligations, reducing the likelihood of conflicts.

- Legal Protection: Payment terms serve as a legal agreement between the buyer and seller. In case of non-payment or breach of terms, the seller can refer to the agreed-upon terms to pursue legal remedies, such as late payment penalties or debt collection.

- Improved Supplier Relationships: For businesses that rely on suppliers, adhering to payment terms is crucial for maintaining good relationships. Timely payments can help negotiate better terms, discounts, and secure priority service or access to limited resources.

- Financial Stability: By following consistent and reliable payment terms, businesses can demonstrate their financial stability and responsibility to lenders, investors, and other stakeholders. This can help them access credit, attract investment, and establish themselves as trustworthy partners.

Common Payment Terms

Payment terms can vary depending on the industry, nature of the transaction, and the relationship between the buyer and seller. Here are some common payment terms:

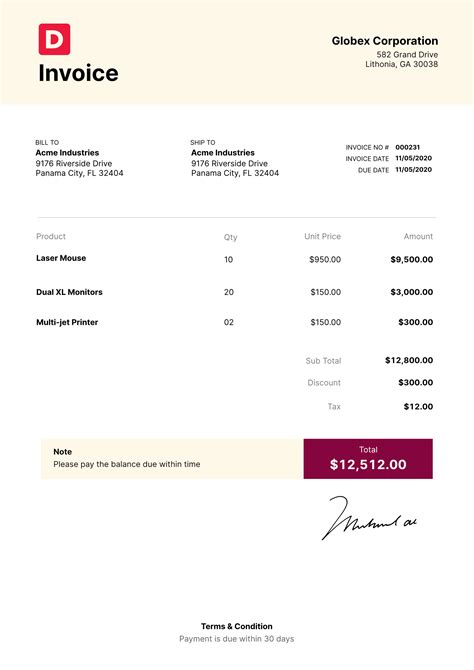

- Net 30: Payment is due within 30 days of the invoice date.

- Net 60: Payment is due within 60 days of the invoice date.

- Net 90: Payment is due within 90 days of the invoice date.

- Due on receipt: Payment is due immediately upon receipt of the goods or services.

- 30 days end of month (EOM): Payment is due at the end of the month following the invoice date.

- Cash on delivery (COD): Payment is due at the time of delivery.

Tips for Establishing Payment Terms

When establishing payment terms, it’s important to consider various factors to ensure they are fair, reasonable, and suitable for your business. Here are some tips to help you set effective payment terms:

- Know Your Industry Standards: Research industry norms and common payment practices to understand what terms are considered standard. This can help you align your terms with industry expectations and avoid potential disputes.

- Consider Your Cash Flow: Analyze your cash flow patterns and financial obligations to determine what payment terms are sustainable for your business. Strike a balance between ensuring timely payments and accommodating your customers’ needs.

- Communicate Clearly: Clearly communicate your payment terms to your customers or clients from the beginning of the business relationship. Include them in contracts, invoices, or purchase orders, and ensure they are easily accessible and understandable.

- Offer Incentives: Consider offering early payment discounts or rewards for prompt payments. This can encourage customers to pay on time and improve cash flow.

- Enforce Late Payment Penalties: Include penalties for late payments in your payment terms to discourage delays. Clearly outline the consequences of late payments, such as interest charges or suspension of services.

- Monitor and Follow Up: Keep track of your outstanding invoices and follow up with customers who have overdue payments. Implement a system to send reminders and escalate the matter if necessary.

- Review and Adapt: Regularly review your payment terms to ensure they remain fair and relevant. Consider adjusting them based on market conditions, customer feedback, or changes in your business needs.

Conclusion

Payment terms play a vital role in maintaining healthy financial transactions and fostering strong business relationships. By establishing clear and fair payment terms, businesses can improve cash flow, reduce payment delays, and build trust with their customers. It is important for both buyers and sellers to understand and adhere to these terms to ensure smooth operations and long-term success.

Frequently Asked Questions (FAQs)

-

What are the consequences of late payments?

Late payments can result in strained cash flow, financial penalties, damaged relationships, and potential legal action. They can also affect your credit rating and reputation in the industry.

-

Can payment terms be negotiated?

Yes, payment terms can often be negotiated between the buyer and seller to accommodate specific circumstances or establish mutually agreeable terms.

-

How can businesses encourage prompt payments?

Businesses can offer incentives for early payments, enforce late payment penalties, and maintain strong communication with customers regarding payment expectations.

-

What should I do if a customer consistently pays late?

If a customer consistently pays late, it may be necessary to reassess the business relationship or implement stricter measures, such as requiring upfront payment or terminating the relationship.

-

Are payment terms legally binding?

Payment terms outlined in a contract or invoice are legally binding. If a party fails to adhere to the agreed-upon terms, the other party may pursue legal remedies.