Pros & Cons Of Independent Contracting

Independent contracting has become a popular way of working, especially in the gig economy. It offers individuals the flexibility to work on their own terms and choose their own projects. However, there are also downsides to this type of work. In this article, we’ll explore the pros and cons of independent contracting to help you decide whether it’s the right choice for you.

Pros of Independent Contracting

Flexibility

One of the biggest advantages of independent contracting is the flexibility it offers. You can work from home, set your own hours, and choose the projects that interest you. This flexibility allows you to balance your work and personal life, which can be especially beneficial if you have family or other personal commitments.

Higher Earnings

Independent contractors are typically paid more than employees for the same work. This is because they are responsible for their own taxes, benefits, and overhead costs. As a result, they can charge higher rates to compensate for these expenses.

Control over Projects

As an independent contractor, you have control over the projects you work on. You can choose clients and projects that align with your interests and skills. This allows you to build a portfolio of work that showcases your expertise and can lead to more opportunities in the future.

Opportunity for Growth

Independent contracting can provide opportunities for professional growth and development. You have the freedom to take on new projects and learn new skills, which can help you expand your services and increase your earnings.

Cons of Independent Contracting

Limited Job Security

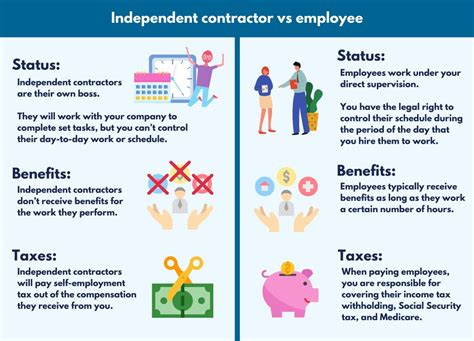

Independent contractors do not have the same job security as employees. They are not entitled to benefits such as health insurance, retirement plans, or paid time off. Additionally, they are not protected by employment laws that govern employee-employer relationships.

Unpredictable Income

As an independent contractor, your income can be unpredictable. You may experience periods of high demand followed by periods of low demand. This can make it difficult to budget and plan for the future.

Self-Employment Taxes

Independent contractors are responsible for paying their own taxes, including self-employment taxes. This can be a complex process, and you may need to hire an accountant or tax professional to help you navigate it.

Overhead Costs

As an independent contractor, you are responsible for your own overhead costs, such as equipment, software, and office space. These costs can add up quickly and eat into your earnings.

Conclusion

Independent contracting offers many benefits, including flexibility, higher earnings, control over projects, and opportunities for growth. However, there are also downsides to this type of work, such as limited job security, unpredictable income, self-employment taxes, and overhead costs. Ultimately, the decision to become an independent contractor depends on your personal preferences and circumstances.

FAQs

1. What is independent contracting?

Independent contracting is a type of work arrangement in which an individual provides services to a client on a project-by-project basis. Independent contractors are self-employed and are not considered employees.

2. How do I become an independent contractor?

To become an independent contractor, you will need to register your business and obtain any necessary licenses or permits. You will also need to find clients and negotiate contracts.

3. What are the advantages of independent contracting?

The advantages of independent contracting include flexibility, higher earnings, control over projects, and opportunities for growth.

4. What are the disadvantages of independent contracting?

The disadvantages of independent contracting include limited job security, unpredictable income, self-employment taxes, and overhead costs.

5. How do I manage my taxes as an independent contractor?

As an independent contractor, you will need to pay self-employment taxes. It is recommended that you work with an accountant or tax professional to ensure that you are managing your taxes correctly.