Understanding Annual Income: Calculation And Definition

If you are looking to understand your financial situation or want to apply for a loan or mortgage, it is crucial to know the concept of annual income. Annual income is the amount of money that an individual earns in a year, including salary, wages, bonuses, commissions, and any other sources of income. It is a critical factor in determining your tax liability, creditworthiness, and financial stability. In this post, we will explore the definition of annual income, how to calculate it and its importance.

What is Annual Income?

Annual income is the total amount of money earned by an individual in a year. It includes all sources of income, such as salary, wages, tips, interest, dividends, capital gains, rental income, and any other income received during the year. It is an important factor in determining your financial situation, tax liability, creditworthiness, and eligibility for loans and mortgages.

How to Calculate Annual Income?

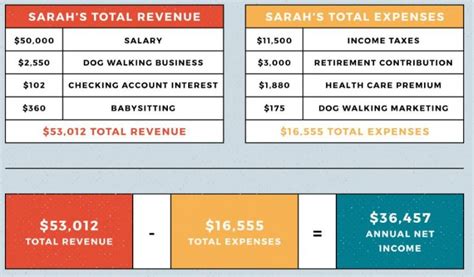

Calculating annual income can be a straightforward process if you have a fixed salary or income. However, if you have multiple sources of income, it can be more challenging. Here are the steps to calculate your annual income:

- Calculate your gross income: This includes all sources of income before taxes and deductions.

- Calculate your net income: This is your gross income minus taxes and deductions.

- If you have multiple sources of income, add them all together to get your total annual income.

For example, if you have a salary of $50,000 per year and a rental income of $10,000 per year, your total annual income would be $60,000 per year.

Why is Annual Income Important?

Annual income is an essential factor in determining your financial situation and eligibility for loans and mortgages. Here are some reasons why annual income is important:

- Tax Liability: Your annual income is used to determine your tax liability. Depending on your income level, you may be required to pay federal, state, and local taxes.

- Creditworthiness: Lenders use your annual income to determine your creditworthiness. A higher income can indicate that you are more likely to repay your debts, making you a more attractive candidate for loans and mortgages.

- Financial Stability: Your annual income can be an indicator of your financial stability. A higher income can mean that you have more disposable income to save, invest, or pay off debts.

- Loan and Mortgage Eligibility: Lenders use your annual income to determine your eligibility for loans and mortgages. A higher income can increase your chances of approval and allow you to qualify for higher loan amounts.

FAQs

What counts as annual income?

Annual income includes all sources of income earned during the year, such as salary, wages, tips, interest, dividends, capital gains, rental income, and any other income received during the year.

How do I calculate my annual income if I have multiple sources of income?

To calculate your annual income with multiple sources of income, add up all sources of income to get your total annual income.

Why is annual income important for loan and mortgage eligibility?

Lenders use your annual income to determine your creditworthiness and ability to repay debts. A higher income can increase your chances of approval and allow you to qualify for higher loan amounts.

Is my annual income the same as my net income?

No, your annual income is your total income earned during the year before taxes and deductions. Your net income is your total income after taxes and deductions.

How can I increase my annual income?

You can increase your annual income by negotiating a higher salary, taking on additional work, starting a side business, investing, or obtaining additional education or certifications.

Conclusion

Knowing your annual income and how to calculate it is crucial for your financial well-being and eligibility for loans and mortgages. Understanding the importance of annual income can help you make informed decisions about your finances, taxes, and investments. By following the steps outlined in this post, you can calculate your annual income and take steps to increase it.