Cash Flow Statement: Using The Indirect Method

Managing the cash flow of a business is crucial for its financial stability and growth. One of the key financial statements used to analyze and track a company’s cash inflows and outflows is the Cash Flow Statement. This statement provides valuable insights into the liquidity and operating activities of a business.

What is a Cash Flow Statement?

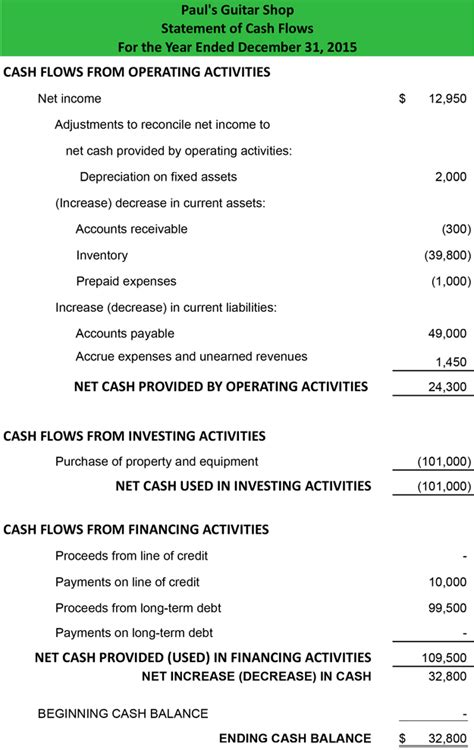

A Cash Flow Statement is a financial statement that shows the changes in a company’s cash position over a specific period of time. It provides information on how cash is generated and used by a business. The statement is divided into three main sections: operating activities, investing activities, and financing activities.

1. Operating Activities

The operating activities section of the Cash Flow Statement includes cash transactions related to a company’s core business operations. This includes cash generated from sales, interest received, and dividends received. It also includes cash payments for expenses, salaries, and taxes.

Example:

XYZ Corporation, a software development company, generated $500,000 in cash from its software sales and received $20,000 in interest from its investments. The company paid $200,000 for salaries and $50,000 for rent and utilities. The net cash provided by operating activities is $270,000. This indicates that the company has a positive cash flow from its core business operations.

2. Investing Activities

The investing activities section of the Cash Flow Statement includes cash transactions related to the acquisition or sale of long-term assets, such as property, plant, and equipment. It also includes cash flows from investments in other companies, loans made to other entities, and the proceeds from the sale of these investments.

Example:

XYZ Corporation sold a piece of land for $100,000 and purchased new equipment for $50,000. The net cash used in investing activities is $50,000. This indicates that the company has invested cash in acquiring long-term assets.

3. Financing Activities

The financing activities section of the Cash Flow Statement includes cash transactions related to the company’s financing sources and capital structure. This includes cash flows from issuing or repurchasing equity shares, issuing or repaying debt, and paying dividends.

Example:

XYZ Corporation issued new shares and received $200,000 in cash. The company also repaid a long-term loan of $100,000. The net cash provided by financing activities is $100,000. This indicates that the company has raised cash from its financing activities.

Using the Indirect Method

There are two methods for preparing the Cash Flow Statement: the direct method and the indirect method. The indirect method is the most commonly used method and focuses on adjusting net income to determine the net cash provided by operating activities.

1. Start with Net Income

The first step in preparing the Cash Flow Statement using the indirect method is to start with the net income from the income statement. Net income is adjusted by adding or subtracting non-cash expenses and gains/losses, and by considering changes in working capital accounts.

Example:

XYZ Corporation’s net income for the year is $500,000. To calculate the net cash provided by operating activities, adjustments need to be made for non-cash expenses and changes in working capital accounts.

2. Adjust for Non-Cash Expenses

Non-cash expenses, such as depreciation and amortization, are added back to the net income as they do not involve cash outflows. These expenses are deducted from net income to calculate operating income, so they need to be added back to determine the net cash provided by operating activities.

Example:

XYZ Corporation incurred $50,000 in depreciation expenses during the year. This amount needs to be added back to the net income to calculate the net cash provided by operating activities.

3. Consider Changes in Working Capital

Changes in working capital accounts, such as accounts receivable, accounts payable, and inventory, also need to be considered. An increase in these accounts represents a use of cash, while a decrease represents a source of cash.

Example:

XYZ Corporation’s accounts receivable increased by $20,000 during the year. This means that the company received $20,000 less in cash from its customers than it recognized as revenue. This amount needs to be subtracted from the net income to calculate the net cash provided by operating activities.

4. Calculate the Net Cash Provided by Operating Activities

After making all the necessary adjustments, the net cash provided by operating activities can be calculated. This represents the cash generated or used by the company’s core business operations.

Example:

After adding back the depreciation expense and subtracting the increase in accounts receivable, the net cash provided by operating activities for XYZ Corporation is $530,000.

Conclusion

The Cash Flow Statement is an essential financial statement that provides valuable insights into a company’s cash inflows and outflows. By using the indirect method, businesses can accurately analyze their cash flow from operating activities. This information is crucial for making informed financial decisions and ensuring the financial stability and growth of a company.

Frequently Asked Questions

1. Why is the Cash Flow Statement important?

The Cash Flow Statement is important because it provides information about a company’s ability to generate cash, its liquidity position, and its cash flow from operating, investing, and financing activities. It helps investors, creditors, and other stakeholders assess the financial health of a business.

2. What is the difference between the direct method and the indirect method?

The direct method and the indirect method are two methods for preparing the Cash Flow Statement. The direct method directly reports cash receipts and payments, while the indirect method adjusts net income to determine the net cash provided by operating activities. The indirect method is more commonly used as it is easier to prepare and provides more detailed information.

3. Can a company have a negative net cash provided by operating activities?

Yes, a company can have a negative net cash provided by operating activities. This indicates that the company has used more cash in its core business operations than it has generated. It could be a sign of financial difficulties or inefficiencies in managing cash flow.

4. What are some limitations of the Cash Flow Statement?

Some limitations of the Cash Flow Statement include the fact that it only provides information about cash flows and does not consider non-cash items. It also does not provide information about the timing of cash flows or the quality of earnings. Additionally, the Cash Flow Statement may not accurately reflect the future performance or financial health of a company.